April 2025 Results

Key takeaways

- Small business optimism recovered timidly to reach pandemic-level optimism;

- Negative employment plans;

- Average price increase planned for the next 12 months remained elevated at 3.5%.

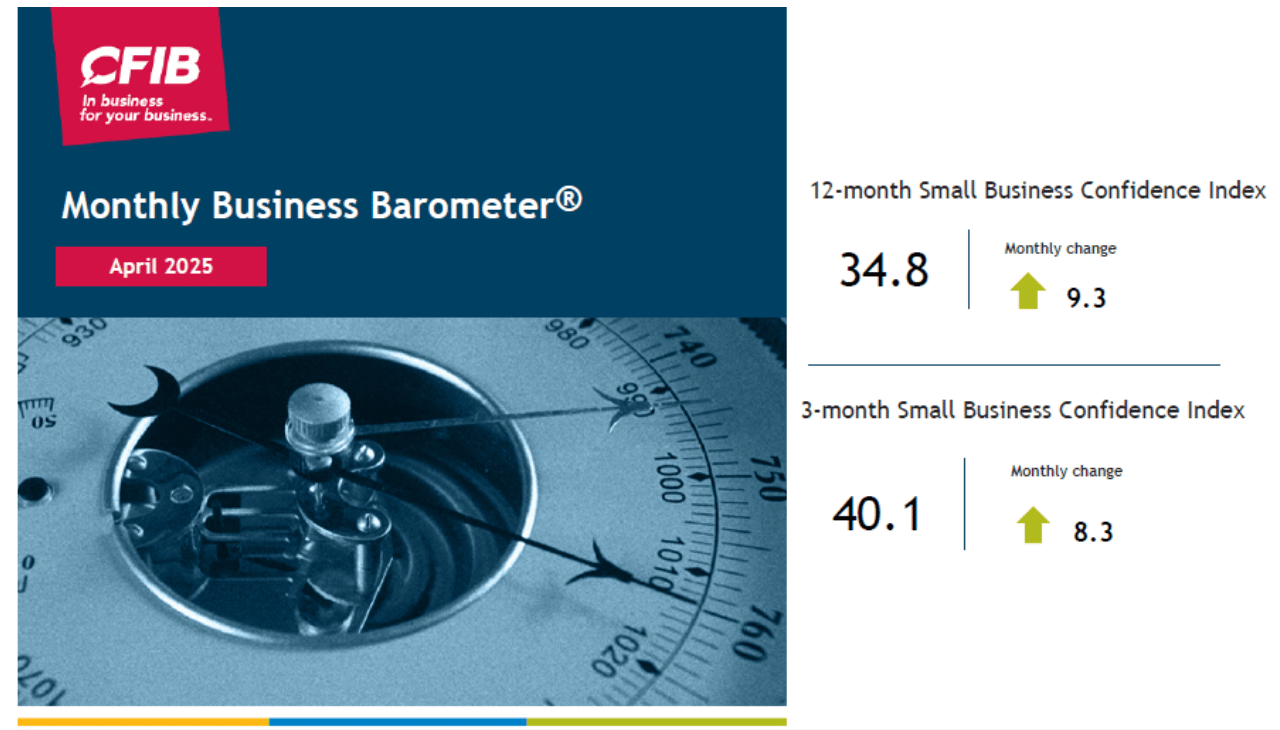

Small business optimism in Canada

CFIB’s Business Barometer® long-term index, which is based on 12-month forward expectations for business performance, recovered timidly reaching 34.8—about 10 points above March level but far below the historical average. The short-term optimism index, based on a 3-month outlook, edged upwards also by 8 points to 40.1. While the long-term optimism has trended in the right direction, the current level is similar to March 2020 reading, the beginning of the pandemic.

Impact of Tariffs on SMEs

The U.S. tariffs are already having a negative impact on small and mid-sized firms as indicated by 70% of them in a recently added question. About one fifth indicate no impacts yet, while 7% are unsure about the impacts. These results show the impact of the tariff war is worsening since March.

As seen in March, optimism among SMEs trading internationally is significantly lower than that of firms dealing only in Canada.

Provincial picture

All jurisdictions maintained their very low levels of optimism or modestly recovered. The four largest provinces ranged in the low to mid-30s for long term confidence.

Sectoral overview

The small recovery of confidence was felt particularly by businesses in retail, hospitality, and construction. Another decline in optimism was felt by firms in agriculture, and wholesale.

Inflation indicators

The average price increase indicator remained elevated at 3.5%. The average wage increase planned for the next 12 months zig-zagged back to the February level of 2.2%. For more information about detailed price and wage increase plans, click here.

Other indicators

Full-time staffing plans recovered slightly also in April, but they are well below normal for this time of the year. Currently, 14% of firms are planning to hire and 17% are estimating layoffs for the next 12 months.

Some key cost constraints hindering business growth have lessened this month – such as fuel costs, tax or wage costs concerns, while others have gained more momentum – such as input product costs (as reported by 45% of SMEs) and equipment and technology costs (34%). Insufficient demand remains the primary barrier to business and production expansion (as reported by 55% of SMEs).

Methodology

These results are based on 417 responses received from April 3 to 8 from a stratified random sample of CFIB members to a controlled-access web survey. Findings are statistically accurate to +/- 4.8 per cent 19 times in 20. Every new month, the entire series of indicators is recalculated for the previous month to include all survey responses received in that previous month. Measured on a scale between 0 and 100, an index below 50 means owners expecting their business’s performance to be weaker over the next three or 12 months outnumber those expecting stronger performance.

The next Business Barometer will be released on May 22, 2025.

For regional information about business optimism, price plans, limitations and main cost constraints for SMEs, please visit: the Business Barometer, 2024 Retrospective.

Andreea Bourgeois, Director of Economics

Simon Gaudreault, Vice-President, Research and Chief Economist

Laure-Anna Bomal, Economist

Related Documents

| Release Date | Report | Download |

|---|---|---|

| April 2025 | Business Barometer® National Summary |

PDF (1.7 MB) |

| April 2025 | Business Barometer® Provincial Summaries |

PDF (700 KB) |

| April 2025 | Business Barometer® Industry Summaries |

PDF (1.4 MB) |

| April 2025 | Business Barometer® Data Table |

Excel (360 KB) |

| April 2025 | Business Barometer® Price and Wage Increase Plans |

PDF (500 KB) |

| January 2024 | Current Survey |

PDF (603 KB) |

| April 2020 | Survey - before 2024 |

PDF (84 KB) |

Share Article

Share Article

Print Article

Print Article