March 2025 Results

Key takeaways

- Small business optimism is at its lowest it has ever been since 2000;

- Very weak employment plans;

- Average price increase planned for the next 12 months registered the largest jump since the pandemic.

Small business optimism in Canada

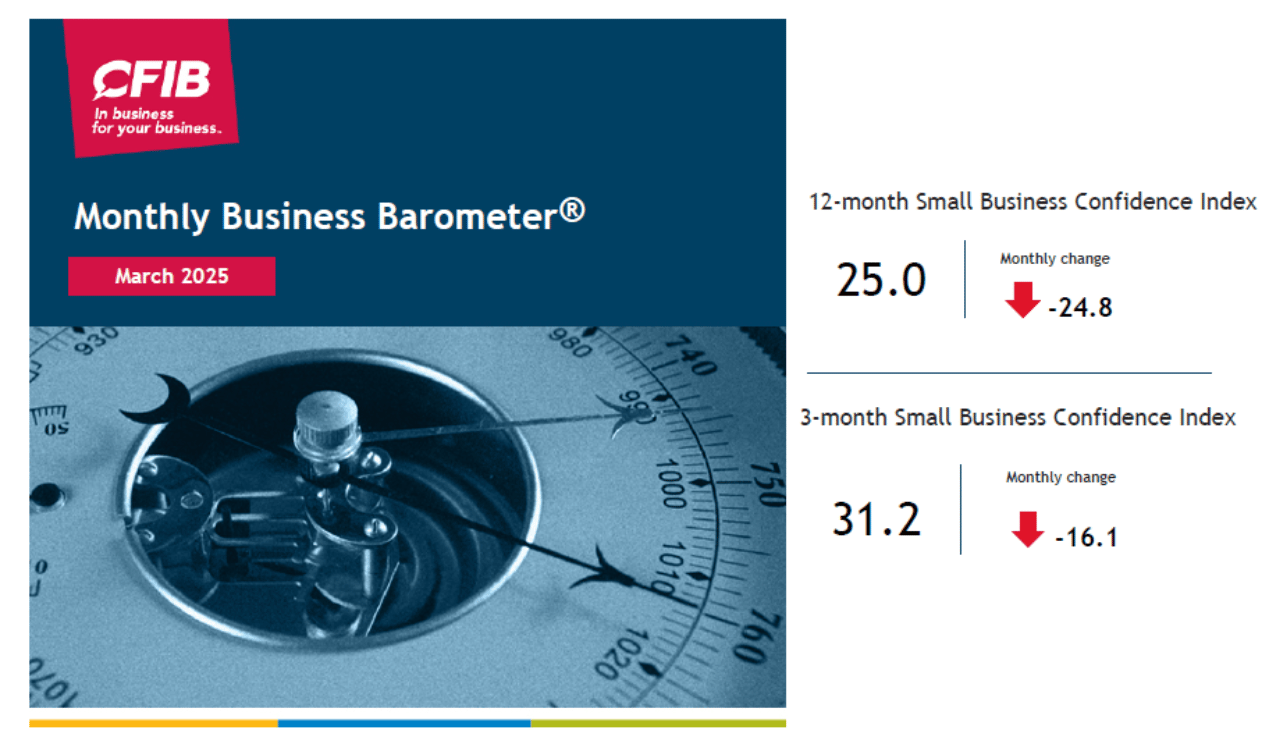

CFIB’s Business Barometer® long-term index, which is based on 12-month forward expectations for business performance, registered its most severe fall since its inception in 2000. The current level of 25.0 is an abysmal 24.8 points below its previous month’s reading. The short-term optimism index, based on a 3-month outlook, also plummeted at a very low level of 31.2.

The small business confidence indicator reached a lower mark than it did during the 2020 pandemic, 2008 financial crisis or 9/11. The tariffs, counter-tariffs and threats of additional tariffs are taking a significant toll on business optimism.

Impact of Tariffs on SMEs

The U.S. tariffs are already having a negative impact on small and mid-sized firms as indicated by 62% of them in a recently added question. About one quarter indicate no impacts yet, while 12% are unsure about the impacts.

Optimism among firms doing business internationally dropped severely this month.

Provincial picture

Optimism in all provinces crashed to levels never seen previously. All index levels range from low-20s to mid-30s. Ontario, Alberta, and Quebec register readings around 24, and are among the least optimistic ones.

Sectoral overview

The sectoral outlook is just as bad with a wider range of confidence levels – from 17.0 for hospitality to 41.7 for financial services. Hospitality, manufacturing, transportation and agriculture are at the very bottom of the optimism scale with indexes below 20 or just a tad shy above.

Inflation indicators

These indicators show a dramatical change this month. The average price increase indicator jumped from 3.0 in February to 3.7 in March. The average wage increase dropped to 1.9, showing signs of a slowdown in the labour market. For more information about detailed price and wage increase plans, click here.

Other indicators

Full-time staffing plans turned negative with higher shares of firms looking to lay off staff than to hire. Hiring trends for 2025 are well below usual annual tendencies; while laying off trends are significantly above normal readings for this time of the year.

Insufficient demand has been steadily trending upwards since November 2024, reaching its new high of 59% of affected small firms in March. Product input costs leaped suddenly as reported by 49% of firms.

Methodology

These results are based on 1,065 responses received from March 5 to 7 from a stratified random sample of CFIB members to a controlled-access web survey. Findings are statistically accurate to +/- 3.0 per cent 19 times in 20. Every new month, the entire series of indicators is recalculated for the previous month to include all survey responses received in that previous month. Measured on a scale between 0 and 100, an index below 50 means owners expecting their business’s performance to be weaker over the next three or 12 months outnumber those expecting stronger performance.

The next Business Barometer will be released on April 17, 2025. Starting this month, the releases will be on the 3rd Thursday of every month.

For regional information about business optimism, price plans, limitations and main cost constraints for SMEs, please visit: the Business Barometer, 2024 Retrospective.

Andreea Bourgeois, Director of Economics

Simon Gaudreault, Vice-President, Research and Chief Economist

Laure-Anna Bomal, Economist

Related Documents

| Release Date | Report | Download |

|---|---|---|

| March 2025 | Business Barometer® National Summary |

PDF (1.9 MB) |

| March 2025 | Business Barometer® Provincial Summaries |

PDF (1.3 MB) |

| March 2025 | Business Barometer® Industry Summaries |

PDF (1.4 MB) |

| March 2025 | Business Barometer® Data Table |

Excel (360 KB) |

| March 2025 | Business Barometer® Price and Wage Increase Plans |

PDF (736 KB) |

| January 2024 | Current Survey |

PDF (603 KB) |

| April 2020 | Survey - before 2024 |

PDF (84 KB) |

Share Article

Share Article

Print Article

Print Article