SKY HIGH COSTS ARE CRUSHING MY BUSINESS!

Government needs to reduce the cost of doing business in Canada!

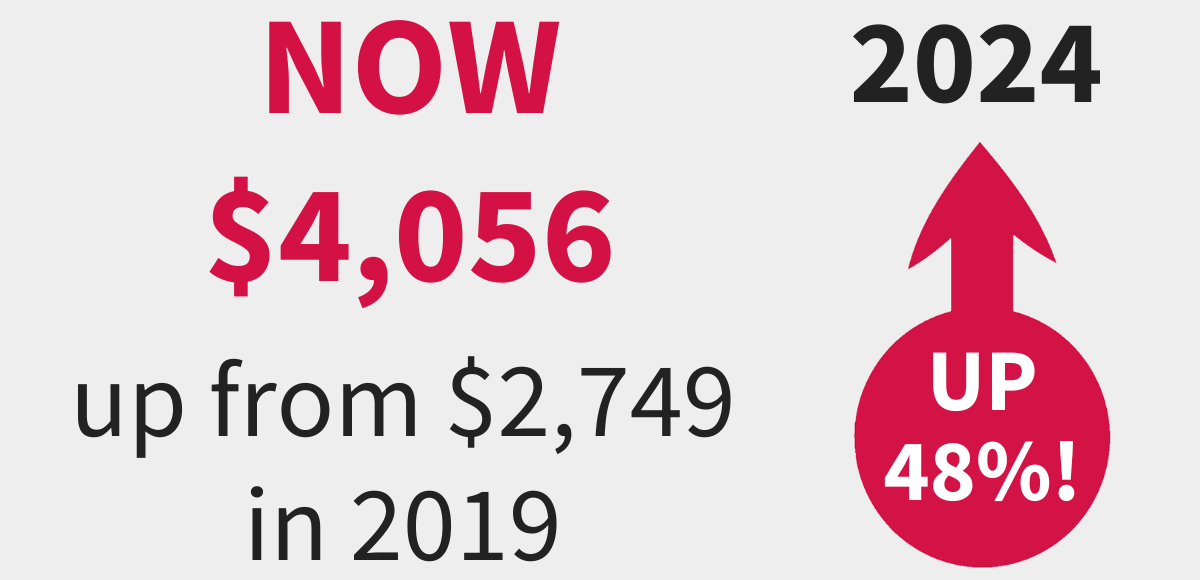

CPP

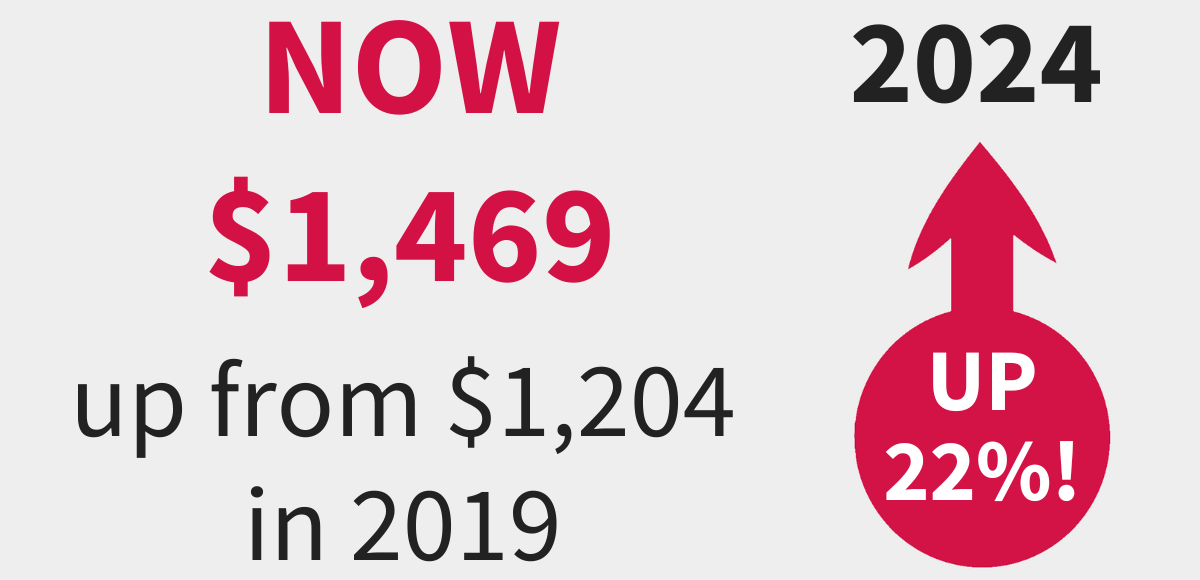

EI

Labour & Insurance Costs

Huge subsidies for Big Business!

Sign the petition

Hon. François-Philippe Champagne, Minister of Finance

CC: My Member of Parliament

The cost of everything is going up! In the last five years alone: the carbon tax is up, the CPP is up, EI premiums are up! The costs of labour and insurance have skyrocketed.

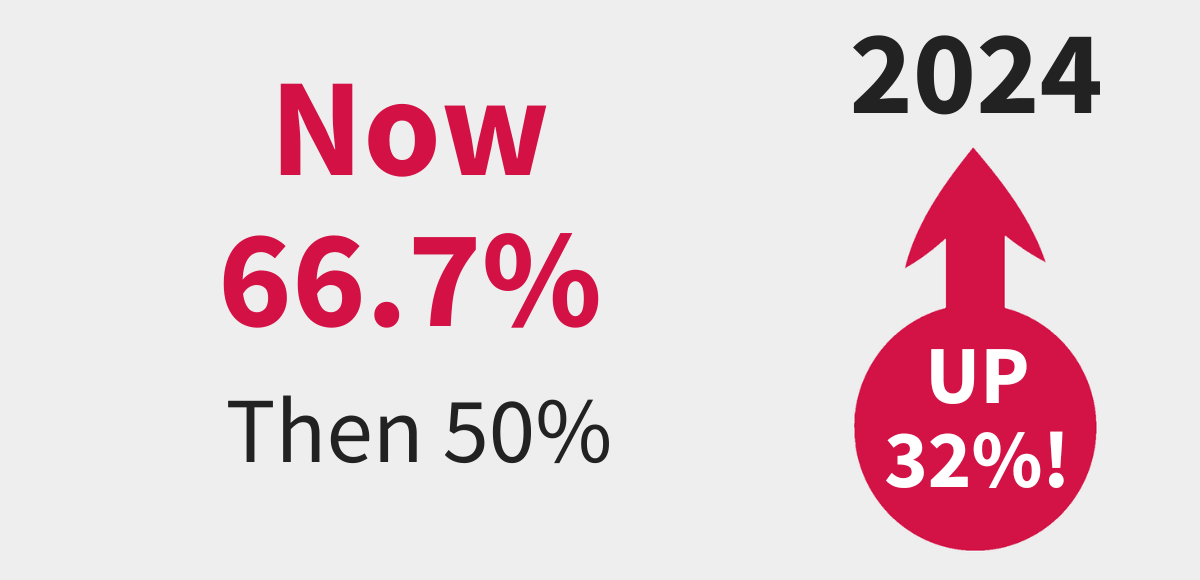

Now, new changes to capital gains are squeezing my savings!

My business can’t take it! It’s time for you to step in and reduce the cost of doing business in Canada!

To keep small businesses like mine on track, I am urging you to:

- Eliminate the carbon tax and return all the money paid in by small business owners in a fair manner.

- Keep the capital gains inclusion rate at 50%, instead of increasing it to 66.7%.

- Expand the new Canadian Entrepreneurs Incentive to all business sectors.

- Include the sale of assets in the calculation for the Lifetime Capital Gains Exemption and the Canadian Entrepreneurs Incentive.

- Introduce a lower Employment Insurance (EI) premium rate for smaller employers.

- Pause any CPP premium or threshold increases.

- Reduce the Small Business Tax Rate and increase the Small Business Tax Rate threshold to $700,000 and index it to inflation.

The Canadian Federation of Independent Business (CFIB) is Canada’s largest association of small and medium-sized businesses with 100,000 members across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings.