Municipalities must help, not harm, my business!

We need strong municipal leadership to thrive

![]() 53% of small business owners listed property tax as the most harmful tax or cost for their business.

53% of small business owners listed property tax as the most harmful tax or cost for their business.

Increasing property tax unfairness - shift the burden!

Property Tax Fairness Ratio* for Six Major Municipalities in Alberta

* Small businesses are greatly impacted by the spending decisions of municipal governments because they pay a disproportionate share of property taxes in their communities. The “property tax fairness ratio” is a measure of the difference of what commercial properties are assessed at versus the share of property taxes that commercial properties pay. A fairness ratio greater than 1 indicates unfavourable treatment for businesses, where the commercial portion of the property tax share is greater than the commercial portion of the property assessment share.

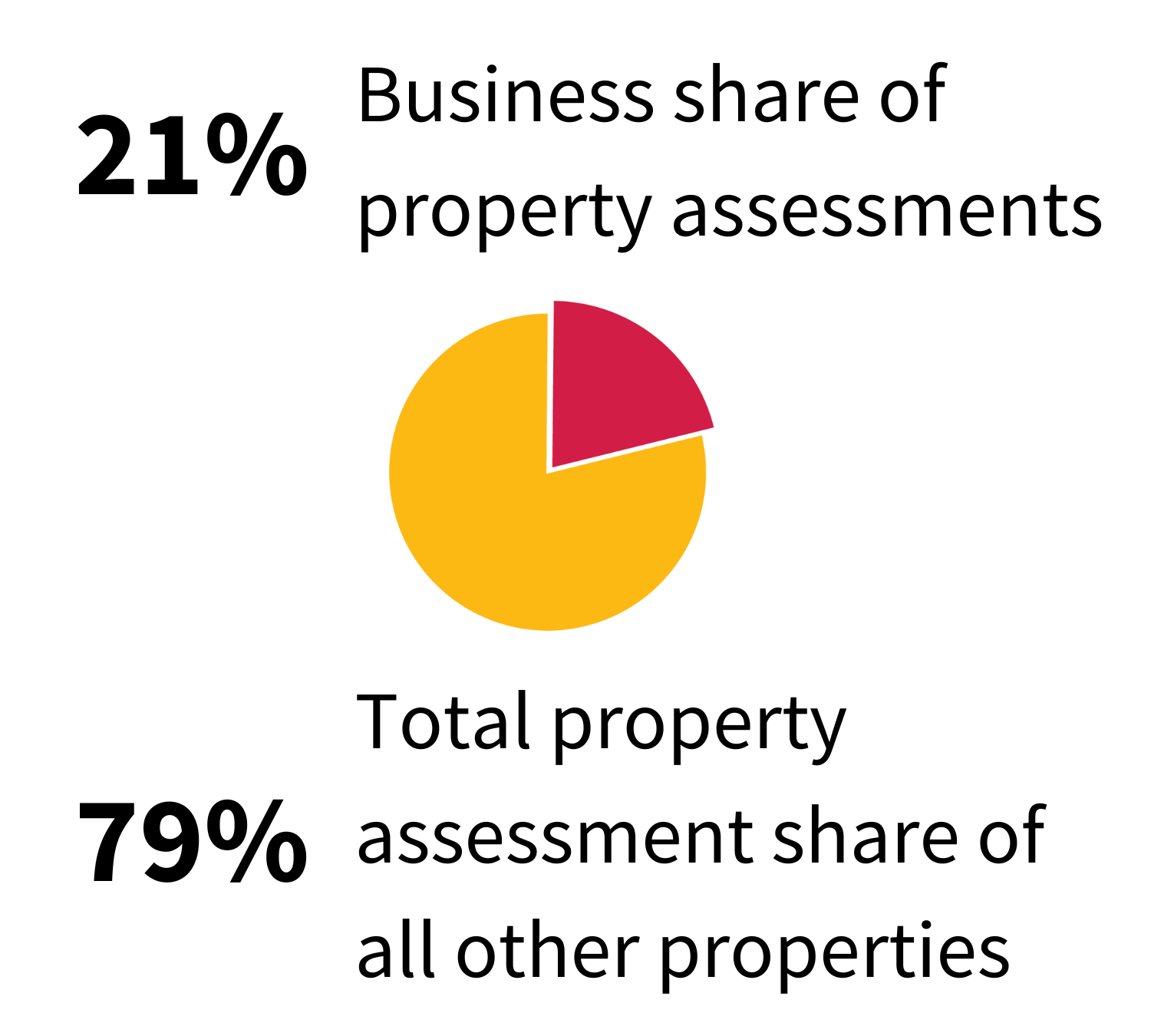

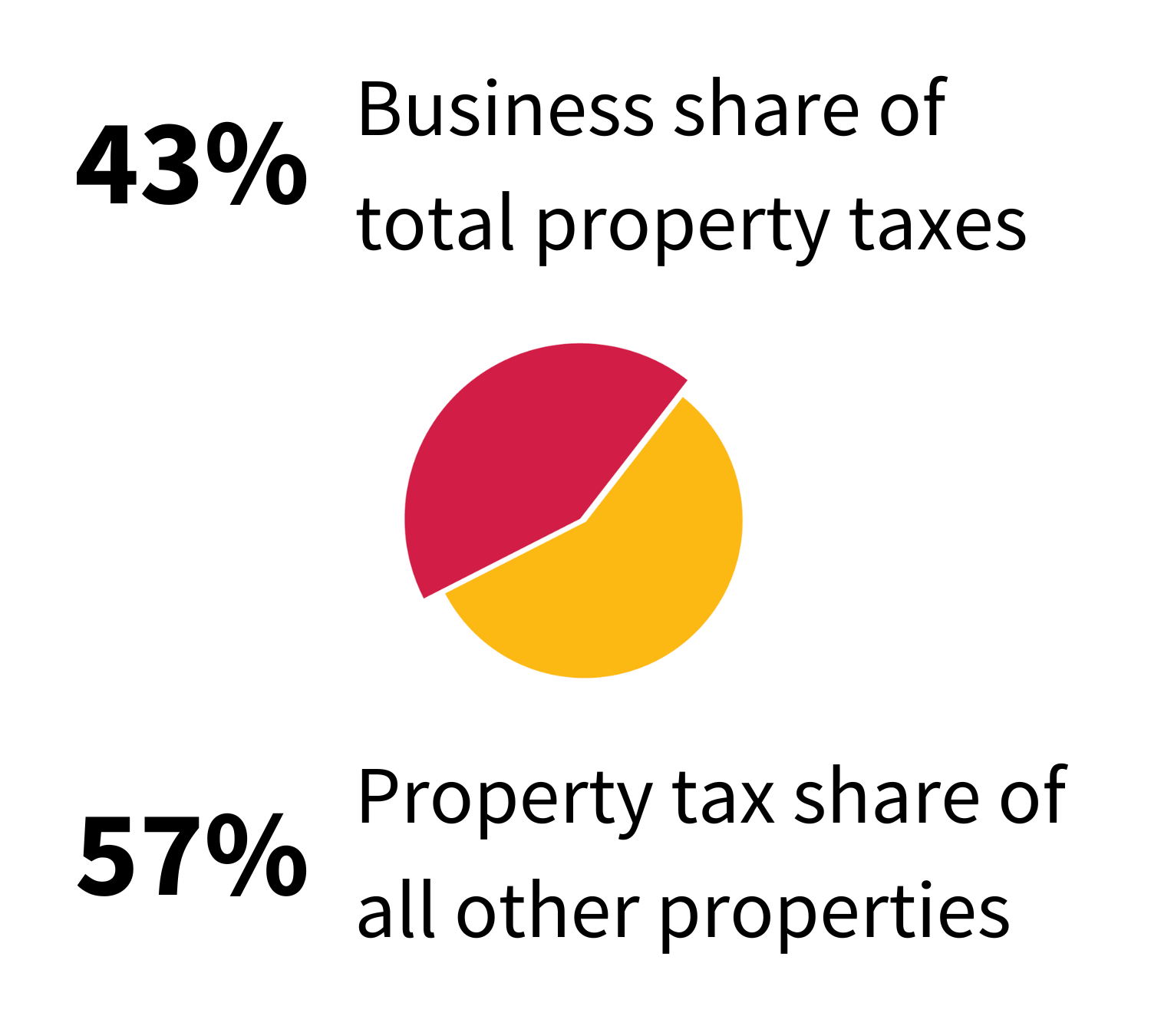

Businesses make up 21% of property tax assessments

BUT they pay 43% of the property taxes

⮩ Annual savings if municipalities shifted 2% of the property tax share to residents:

• Edmonton: $6,737 • Red Deer: $5,033 • Calgary: $5,393 • Lethbridge: $8,068

Construction is wreaking havoc on my business!

![]() 508 DAYS: Average time construction disrupts small businesses. Projects must stick to timelines!

508 DAYS: Average time construction disrupts small businesses. Projects must stick to timelines!

![]() 65% of SMEs believe government should compensate businesses for long-term construction disruption

65% of SMEs believe government should compensate businesses for long-term construction disruption

![]() Thanks to CFIB advocacy, Montreal, Quebec City, and Levis in Quebec have support programs for heavy construction periods!

Thanks to CFIB advocacy, Montreal, Quebec City, and Levis in Quebec have support programs for heavy construction periods!

![]() While Calgary conducted a temporary construction mitigation pilot based on CFIB’s recommendation, more needs to be done.

While Calgary conducted a temporary construction mitigation pilot based on CFIB’s recommendation, more needs to be done.

![]() ALBERTA MUNICIPALITIES NEED TO TAKE THE LEAD!

ALBERTA MUNICIPALITIES NEED TO TAKE THE LEAD!

Sign the petition

My Mayor and Council

As a small business owner, I’m struggling to keep up with the rising cost of operating in my community – with sky high municipal property taxes and disruptive, unaccountable construction as two of the main culprits.

Property taxes are not only too high, but they also fall disproportionately on small businesses. This unfair distribution and constant increases are unsustainable for my business.

As my community grows, so does construction. I understand the need for development, but when that construction drives away customers and disrupts my operations, I need support. Relief is required when my business suffers through no fault of my own!

I need you to take the following action now to support my business and protect economic growth:

- Don’t introduce further cost increases (i.e. increased license and permitting fees)

- Commit to lower and fairer property taxes

- Have a construction mitigation plan that ensures accountability and compensates businesses for construction-related revenue losses

- Reduce spending by finding internal efficiencies

- Reduce municipal red tape

- Encourage shop local campaigns

The Canadian Federation of Independent Business (CFIB) is Canada’s largest association of small and medium-sized businesses with 100,000 members across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings.