Cut taxes for Alberta’s small businesses now!

Alberta’s economic landscape should benefit businesses like yours — the ones driving our province’s growth!

You asked, CFIB delivered!

Alberta introduced a NEW personal tax bracket of 8% (down from 10%).

Where Alberta small businesses stand

| 83% are concerned about economic uncertainty. | 72% say rate tax reductions are the most beneficial solution to counterbalance trade issues. |

Small Business Tax Rate (SBTR)

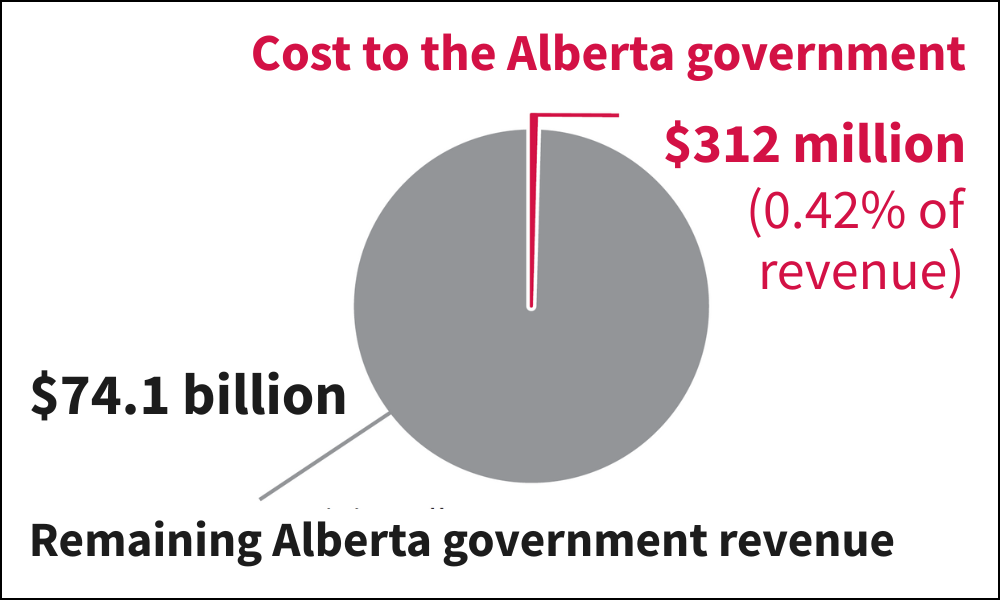

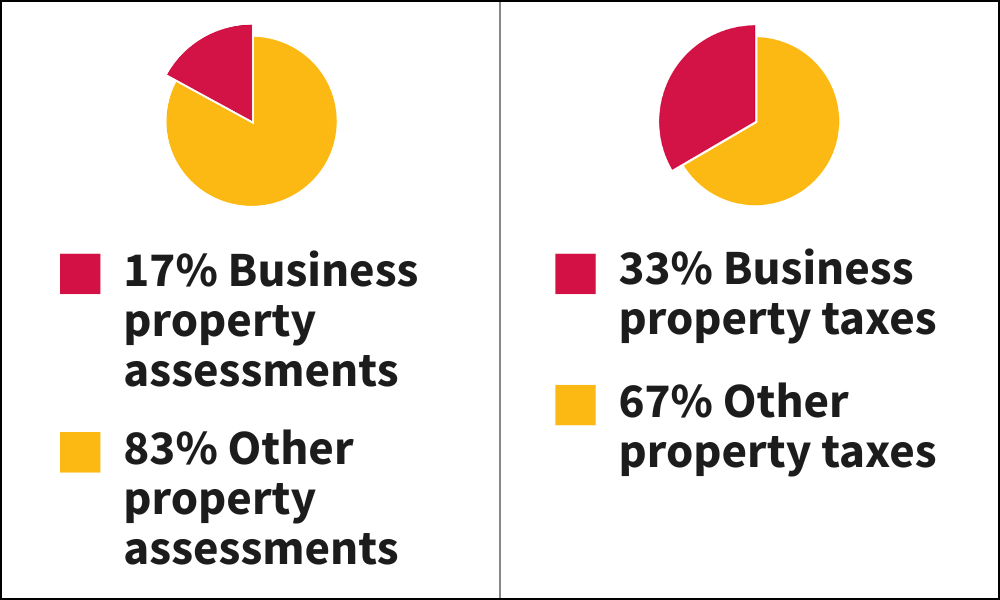

Education Property Tax

Lowering the insurance premium tax rate by 2% will save taxpayers $372M in insurance costs.

ALL OF THE ABOVE = MORE MONEY IN YOUR POCKET!

Sign the petition

Premier Smith

CC: My Member of the Legislative Assembly

Economic uncertainty is driving up costs for my small business like never before. The perfect storm of inflation, trade challenges, sky high insurance rates, and sluggish consumer demand is squeezing my bottom line. Your government has the opportunity — and responsibility — to take action and alleviate these burdens.

Lowering taxes isn’t just about helping small businesses — it’s about securing a prosperous future for all Albertans.

To help offset the increased costs of doing business and keep my business competitive, I am calling on you to:

- Reduce the small business tax rate to 0% (currently at 2%) and increase its threshold to $700,000, indexed to inflation.

- Reduce the education property tax (current non-residential rate set at $4 per $1,000 of assessment value).

- Reduce the insurance premium tax to 2% (currently at 4%).

The Canadian Federation of Independent Business (CFIB) is Canada’s largest association of small and medium-sized businesses with 100,000 members across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings.