Simple and secure payments with Chase Payment SolutionsSM

Never miss a sale with Chase Payment Solutions, CFIB’s preferred payment processor. Seamlessly accept payments in-store, on-the-go, online or over the phone.

Unlock exclusive CFIB member rates

- As a CFIB member, get exclusive rates on credit card and Interac transaction processing with Chase.

- Enjoy no sign-up, cancellation or hidden fees.

- Special discount on terminal rental fees and 70% off the monthly administrative fee.

- Access your funds faster with next-business-day funding.1

Chase: A trusted partner you can rely on

-

A global leader with local Canadian expertise

We serve over 110,000 business locations nationwide, providing industry-leading security and fraud protection to help safeguard your payments, data and reputation.

-

Unmatched guidance and support

Ranked #1 in quality of advice and customer service, we offer best-in-class client service, platform resiliency and operations,2 all backed by 24/7 bilingual support.

-

Scalable payment solutions

Our products are designed to help you get paid at any stage of your business, whether you're just starting out or managing multiple locations.3

-

Seamless integration and flexibility

We collaborate with technology providers to offer flexible payment gateways for a customized and efficient processing experience.

Flexible payment solutions for selling easy

Our solutions cater to businesses of all sizes, from startups to multi-location and e-commerce stores.

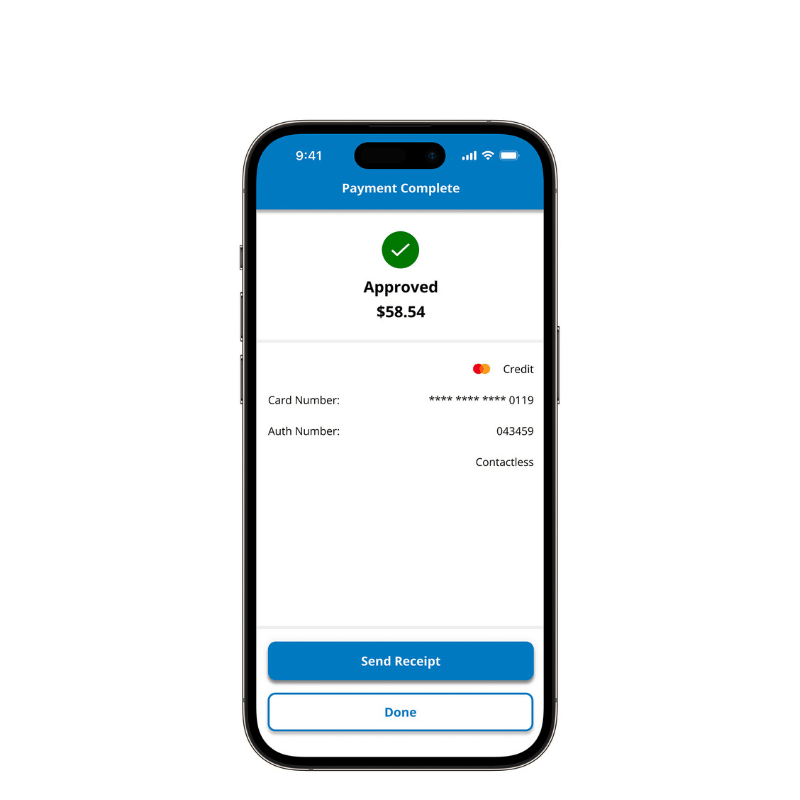

✦ In-Person Payments

Enable payments at the register, around the store or curbside with card terminals, mobile PIN pads and a mobile app.

Accept payments via smartphone with the Chase Mobile Checkout-PLUS4 app and optional contactless mobile card reader.

✦ New! Upgrade your checkout experience and streamline your business with Chase’s all-in-one POS system.

Sell uninterrupted

- Sell anywhere in-store with our portable terminal and POS software

- Seamlessly syncs with the Chase POS Merchant Portal

Manage products

- Add products and pricing to a catalogue

- Track inventory levels from a single source

Track sales with ease

- Monitor cash and card sales

- Real-time reporting and user-friendly dashboards

Simplify bookkeeping

- Effortlessly sync your payment processing data directly with QuickBooks® Online5

✦ Online Payments

- Enhance your e-commerce business with Chase Hosted Checkout, a customizable, bilingual-friendly, consumer-facing hosted payment page that integrates with your website and provides your customers with a secure PCI-compliant checkout experience.

- We also have payment gateways to help you easily accept payments online.

✦ Effortless Payment Solutions

- Chase integrates with hundreds of technology providers to make it easy to accept payments.

- Choose a payment gateway that aligns with your operations for efficient processing.

More than 110K+ small business owners trust Chase for their payments processing.

Hear from some of our members about their experience with Chase.

CFIB and Chase Payment Solutions – a partnership for savings

Since 2008, CFIB has advocated for lower credit card fees, leading to a 2023 agreement with Visa and Mastercard to reduce fees for small businesses. Eligible businesses benefit from a 0.95% average interchange rate for in-store sales and a 0.1% reduction in e-commerce fees. Chase Payment Solutions passes these savings to you, with exclusive rates for CFIB members to lower costs and ensure efficient processing.

Learn how CFIB supports small businesses by addressing fees and chargebacks.

Curious about potential savings? Contact a Chase representative to compare your current payment processing.

At Chase, we focus on payments so you can focus on your business.

Disclosures Show more Show less

- Next-business-day funding on Visa®, Mastercard®, American Express® OptBlue and Interac transactions is available to merchants who submit transactions prior to applicable settlement cut-off times. Next-business-day funding is subject to merchant credit approval, fraud monitoring and the terms of the merchant agreement. All eligible funds are deposited on the next business day, excluding weekends and holidays.

- Coalition Greenwich Voice of Client 2023 U.S. Large Corporate Cash Management.

- Businesses who wish to obtain payment processing services from Chase Payment Solutions must submit an application. All applications are subject to Chase’s standard approval policies and procedures, including, without limitation, credit approval and entering into a merchant agreement with Chase Payment Solutions.

- Chase Mobile Checkout-PLUS is available to Canadian merchants accepting transactions within Canada only. Chase Mobile Checkout-PLUS requires a compatible Apple or Android smartphone or tablet with cellular or Wi-Fi network connection, the Chase Mobile Checkout-PLUS application, a merchant services account with Chase, and a Chase Mobile Checkout-PLUS supported PIN pad. There is no charge to download the Chase Mobile Checkout-PLUS app, but there may be charges associated with the purchase and shipment of the PIN pad. When using the app, message and data rates may apply. Such charges include, but are not limited to, those from your communications service provider. In addition, all applicable processing fees outlined in the merchant services contract with Chase will be assessed for all transactions initiated through the app.

- QuickBooks® Online integration is subject to terms of service. Limitations may apply to data integration.

Find out what you can save!

Let our payment experts help you find the right solutions for your business.

or call:

1-888-317-9535

What does a membership cost?

Monthly membership fees are $34 plus $3 per employee.

Find out what this means for your business.

Want to offer more to your members? If you are responsible for an association or a group of franchisees, we offer you an incomparable alliance that will allow you to offer even more advantages to your members. We have already signed agreements with more than 120 groups across the country and their members now benefit from all CFIB services.

Learn more about group agreements.

Want to offer more to your members? If you are responsible for an association or a group of franchisees, we offer you an incomparable alliance that will allow you to offer even more advantages to your members. We have already signed agreements with more than 120 groups across the country and their members now benefit from all CFIB services.

Learn more about group agreements.