WorkSafeBC should return over nearly $2.9 billion in excess funds | CFIB

CFIB is calling on all governments to follow Ontario’s lead and legislate surplus rebates

Vancouver, May 10, 2022 - The Canadian Federation of Independent Business (CFIB) is once again calling on WorkSafeBC to rebate surplus funds back to small business owners and legislate a refund threshold. CFIB has been tracking WorkSafeBC’s overfunded position for over seven years and delivered over 5,000 petitions signed by small business owners who would like a refund.

CFIB’s latest research snapshot, Workers’ Compensation and Surplus Distributions: A Small Business Perspective, shows WorkSafeBC continues to grow its overfunded position at 153% when their own funding target is 130%. In dollar amounts this equates to nearly $2.9 billion which should be refunded back to business owners who pay into the system. This would amount to a $6,189 rebate for a BC business with five employees who could use that money to help in recovery efforts. A refund could help business owners improve safety and employee training and reinvest in their business.

“Obviously, workers compensation systems need to be adequately resourced to continue the important work of supporting workers and making workplaces safer,” said Annie Dormuth, BC provincial affairs director. “But when you have funds reaching levels that are billions of dollars above even their upper targets, it’s time to return that money to hard-working small business owners.

While seven boards across Canada have rebate policies, last year, Ontario became the first province to legislate mandatory rebates when overfunding reaches a certain level. CFIB is also calling on the BC government to follow Ontario’s example to ensure certainty and consistency for small business owners.

“It is shameful BC is one of only three provinces that has no surplus refund policy, despite having the highest surplus in the country. This year, Ontario rebated $1.5 billion, while Manitoba rebated $95 million. In 2021, Prince Edward Island provided a $25 million rebate. CFIB is urging WorkSafeBC to follow suit and deliver meaningful financial relief to small business owners,” concluded Dormuth.

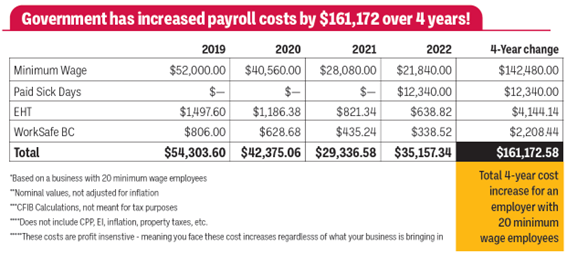

Recent CFIB research shows that over the course of four years the BC government has increased provincial payroll costs by over $161,000 per business with 20 employees earning minimum wage. This figure does not include additional payroll costs by the federal government in the form of EI and CPP.

This shows the impact these changes have on small businesses and the costs that continue to accumulate when recovery is not a reality and businesses are facing other cost pressures. Now is the time for the BC government to show support for hard-working entrepreneurs in the province by providing a WorkSafe BC refund and legislate surplus rebates.

CFIB is calling on all governments to:

- Lower employer premiums or rebate surplus funds to employers, if funding ratio exceeds its target funding, with a stronger preference to rebate eligible employers

- Implement mandatory distribution policies where there are none

- Legislate surplus distribution policies, as in Ontario

For media enquiries or interviews, please contact:

Annie Dormuth BC provincial affairs director

403 700-1945

Annie.dormuth@cfib.ca

About CFIB

The Canadian Federation of Independent Business (CFIB) is Canada’s largest association of small and medium-sized businesses with 95,000 members (9,000 in BC) across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings. Learn more at cfib.ca.