Credit Card Surcharging:

Application deadline EXTENDED for credit card class action settlement claims:

Undocumented & Simplified claims: NOW OPEN until December 30, 2022

Documented Claims: Open until December 30, 2022

As part of a class action lawsuit settlement, Visa and Mastercard have agreed to allow merchants to decide if they want to pass on the cost of accepting credit cards to their customers. Starting October 6, 2022, businesses will be able to charge an additional fee at the point of sale if a customer wishes to pay by credit card.

Due to Consumer protection laws in Quebec, the option to surcharge will not be available to Quebec-based merchants. Quebec based merchants will be allowed to surcharge other merchants.

Did you know that the Credit Card Class Action settlement claim deadline for all sizes of businesses was extended to December 30, 2022? Learn more

As part of a class action lawsuit settlement, Visa and Mastercard have agreed to allow merchants to decide if they want to pass on the cost of accepting credit cards to their customers. Starting October 6, 2022, businesses will be able to charge an additional fee at the point of sale if a customer wishes to pay by credit card.

Due to Consumer protection laws in Quebec, the option to surcharge will not be available to Quebec-based merchants.

The US has been able to surcharge credit card transactions since January 27, 2013

.png)

A recent survey of CFIB members found that 19% of merchants are considering surcharging customers when they pay by credit card

%201.png)

One-in-two businesses report credit card fees have increased in-store in the last 3 years

Eligibility

Application deadline is December 30, 2022!

You’re eligible to receive a portion of the settlement if you:

• Were a merchant in Canada at any point between March 23, 2001, and September 2, 2021,

• Accepted Visa and/or Mastercard credit cards as payment for goods and services,

• Incurred merchant discount fees, including interchange fees.

How to Claim

Starting May 30, 2022, you can submit a claim through the Credit Card Class Action website. What you will need to know:

• Name

• Contact information

• Size of your business / annual revenues during the claim period (can be classified as a small, medium, or large business – see table below)

• Attestation that you collected credit card payments at some point since March 23, 2001 – more information to come on details of attestation requirements

Note: No documentation is required for merchants classified as “small businesses”.

Process

You will receive confirmation that your claim was submitted successfully. Your application will then be reviewed and either approved or denied.

If you are approved, you can expect to receive your funds before the end of 2022 by direct deposit or cheque (opting for a cheque will deduct $2 from your claim).

If you are denied, you will receive a decision notice. No appeal process exists for small business claims. If you have any concerns, you can speak to the claim administrator.

How Much You'll Receive

| Merchant size | Average annual revenue over the claim period | Amount you can receive per year you incurred merchant discount fees |

|---|---|---|

| Small merchant | Less than $5 million | $30 / year (max $600) |

| Medium merchant | Between $5 million to $20 million | $250 / year (max $5,000) |

| Large merchant | $20 million + | $250 / year |

What is a surcharge?

A credit card surcharge is any fee added when a customer decides to pay by credit card. It is different from a convenience fee which merchants can add to a transaction regardless of the method of payment. A credit card surcharge is only added to credit card transactions.

Why surcharging matters

Credit card processing fees can be very difficult to track and come with a significant cost. Over the years, merchants have seen these costs rise, especially smaller merchants who often pay much more than larger companies to accept credit cards making it more difficult for them to compete with large companies. Businesses should be allowed to explain to their customers why their prices increase and decide if they will pass this cost to their customers.

Until now, most businesses were not permitted to surcharge. Following a class action lawsuit, Visa and Mastercard are allowing businesses to pass along the cost of processing a credit card transaction to consumers.

How to start surcharging?

Before beginning to surcharge credit card transactions there are certain considerations to be mindful of, and requirements to meet, to prevent complaints and consequences for the improper implementation of credit card surcharging.

What you need to know before deciding to surcharge credit cards

- Does your business accept Visa or Mastercard?

- Which payment processor do you use to accept credit card payments?

- Which cards (product and brand) will you surcharge?

You can choose to surcharge specific credit card products and brands, however, you may also need to equally surcharge other competing credit networks depending on your agreement with the company that provides you access to credit card card networks (acquirer). Call your acquirer to learn more. - How much will you surcharge customers?

Surcharges are capped at 2.4% or the amount it costs you to accept those credit cards, whichever is less. This percentage or flat rate must be tied to the decision to pay with credit card rather than the good/service. The amount you charge will be your business decision.

- How will you share the surcharge information with your customers?

Educating your customers about this change and its impact on them will be important to mitigating any misunderstandings. You will need to create posters to meet the surcharge disclosure requirements. To save you time and money, CFIB will be creating resources for you to use.

3 Notification requirements at least 30 days before Surcharging:

Step 1) Notify your credit card network

- Notify Mastercard by completing their Merchant Surcharge Disclosure Form

- Visa does not require direct notification or the completion of a form as they require acquirers to notify them

Step 2) Notify your acquirer

At least 30 days before surcharging, contact your acquirer to notify them you will want to start surcharging. We recommend that you send an email, then save the email and confirmation of receipt.

Approvals from your acquirer and processor to surcharge is not required if all the Visa and Mastercard surcharging requirements are met. When contacted, some acquirers and processors may state they are not ready to allow surcharging. This might be because their Point of Sales systems or equipment are not ready to facilitate the itemization and tracking of credit card surcharging. However, they should still be accepting notices of intent to surcharge credit card transactions. More on how to surcharge when your acquirer is not ready can be found in Step 4.

Below is a list of acquirers and links to how they would like you to notify them of your choice to surcharge. Below is a list of acquirers and links to how they would like you to notify them of your choice to surcharge.

This list will be updated as we learn more. Should you come across different/incorrect information please contact our business help line at 1-833-568-2342.

Acquirers & how to notify them about Surcharging:

- Adyen Canada Ltd. – How to configure your POS surcharge

- Bank of America Merchant Services (BAMS) – TBA

- Chase – Functionality will be available for terminal VX4000 by the end of Q3 2024, terminal VX8000 by the end of Q4 2024. Functionality for all other terminal models has yet to be determined.

- Desjardins & Global Payments – Desjardins & Global Payments can now surcharge (Desjardins merchant services were acquired by Global payments.). Merchants contact support at 1-800-599-6491 with their merchant account number if they have questions and to learn how to proceed.

- Elavon – Possible in the USA but not currently in Canada.

- Fiserv – 1-855-348-4811

- Moneris – Moneris continues to evaluate developing a full-service surcharging solution, which will be available no earlier than 2024.

- People’s Trust – TBA

- TD Merchant Services – TD Merchant Services support credit surcharging on the majority of their POS devices.

- Nuvei – Nuvei offers surcharging programs for their merchants. Contact at 1-866-687-3722.

- PSP Services Inc. – TBA

Step 3) Notify your clients (Recommended)

Avoid any misunderstandings by educating your clients directly about the new fee they can expect to see. Explain your reason for surcharging and advise them of alternative methods of payment that can be used to avoid the surcharge. Check out CFIB's template email notification for your customers.

3 Disclosure requirements when surcharging:

Step 4) Post a surcharge disclosure at the point customers enter your business or website

CFIB has a Point of Entry Surcharging poster available for download to ensure you meet all the Visa and Mastercard disclosure requirements for your points of entry here.

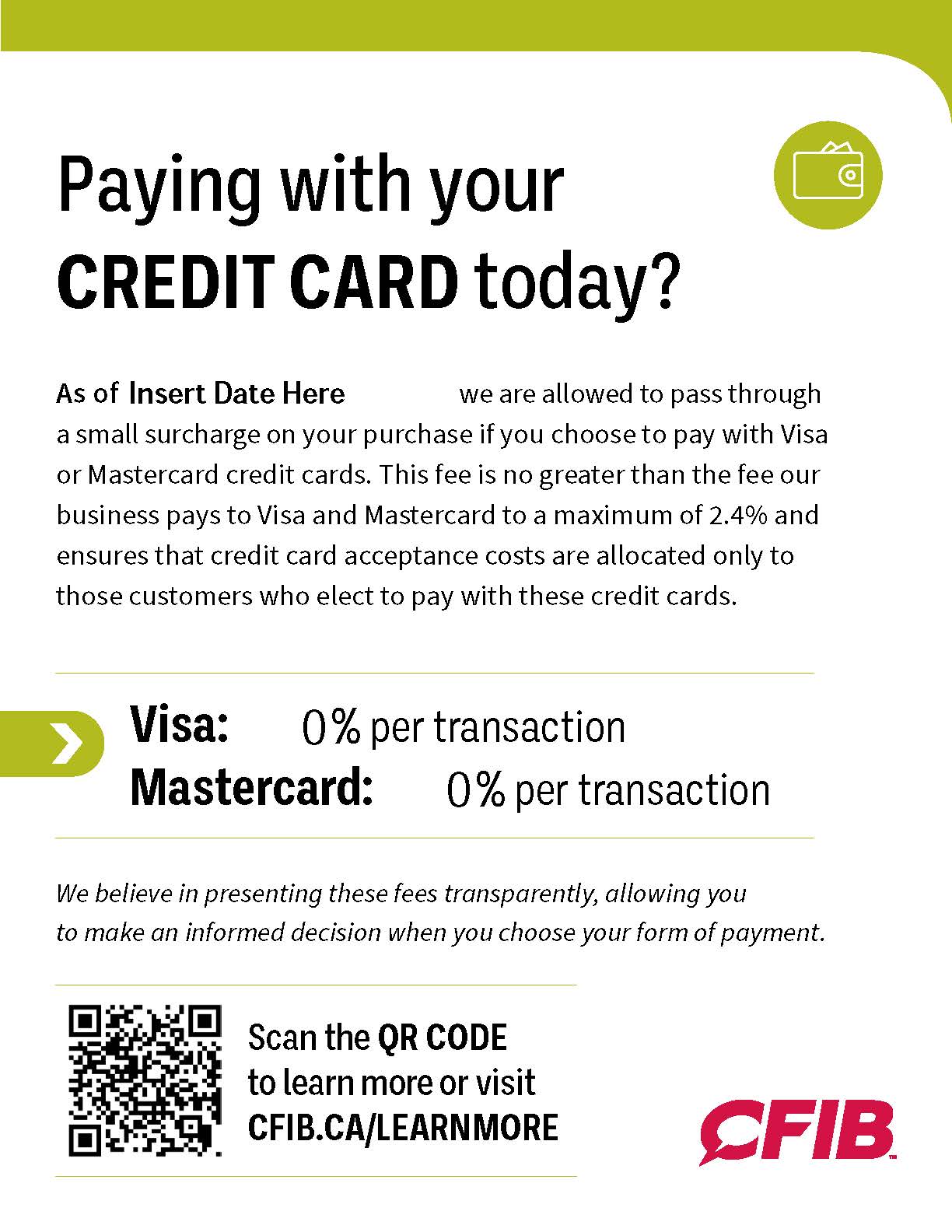

Step 5) Post a surcharge amount/percentage disclosure at the point of sale or transaction

This must be done both in-store and online. Should a sale be over the phone, this must be disclosed verbally. Download CFIB’s Point of Sale Surcharging Poster which was created in partnership with the Credit Card Class Action lawyers to ensure small businesses meet all the Visa and Mastercard disclosure requirements here.

Step 6) Itemize the dollar amount clearly on the customer’s receipt

This can be produced on the receipt provided by you, the cash register, or the point-of-sales machine provided by your credit card processor.

Some processors and acquirers may not be ready to facilitate surcharging. If this is the case for your business, you can try to contact your electronic cash register or point-of-sale system company to get more clarity on how to capture the amount of the surcharge, display the amount on the receipt, and pass that information to your acquirer. Please contact your acquirer to find out if they are ready to facilitate this requirement.

Printable Posters & Templates

Whether you are looking to surcharge or encourage consumers to use alternatives like debit or cash, CFIB has posters, checklists, and email templates to suit your business needs.

Templates

FAQ - Credit Card Surcharging

What is surcharging?

A credit card surcharge is an additional fee that a merchant can choose to charge a consumer’s bill when they pay with a credit card at the point of sale.

Can I charge a fee on Interac payments?

Yes. The ability to add a fee to Interac debit card transactions has been and continues to be available to merchants.

Is a surcharge the same as a convenience fee?

A surcharge is different from a convenience fee.

A surcharge is any fee added to a transaction for using a credit card.

A convenience fee is a fee that merchants may impose on all transactions no matter the method of payment. These can include debit card transactions (Interac).

If a merchant is eligible to surcharge and impose a convenience fee, they cannot add both on the same transaction.

Can I surcharge my clients today?

After a 30-day notice period to Visa, Mastercard, your payment processor, and your clients you would be able to surcharge clients who pay using credit cards. More details can be found in How to start surcharging? section of this webpage

If your business operates in Quebec, the provincial Consumer Protection Act prevents you from surcharging consumers; however, you are able to surcharge other merchants.

Which credit cards will I be able to surcharge and by how much?

Merchants can pick and choose which credit card brands or products they would like to surcharge to a maximum of 2.4%. It will be your decision. You may decide to only surcharge premium cards that charge your business higher fees. The way you choose to surcharge may lower your surcharging maximum.

Brand-level surcharges will be capped at the lesser of the merchant’s average effective merchant discount rate paid to accept credit cards or the 2.4% cap.

Product-level surcharges will be capped at the lesser of the merchant’s cost to accept that particular credit card product or the 2.4% cap.

Can I surcharge in person, over the phone and for online transactions?

Merchants can choose any or all environments in which they surcharge clients. For example, a merchant can choose to only surcharge on online purchases.

Can I decide to surcharge discounted or sale items only?

No, surcharges should be specific to the client’s choice to pay for their transaction by credit card.

Should I register to surcharge as soon as it becomes available?

This depends on your business. Registering for surcharging will continue to be available for merchants moving forward. Should you wish to surcharge as soon as possible, please know that a 30-day notice period must pass before you can surcharge customers.

Do I charge sales tax on the surcharge?

We are awaiting information on this. We have heard the disclosure could be as simple as a line item after the subtotal with a description indicating the amount is a surcharge.

Who do I contact for technical issues with registering to surcharge?

Each credit card network has set up its own registration system to monitor who will begin surcharging. Please contact the credit card network and/or acquirer with whom you are registered. This will depend on the rules of your surcharging agreement.

What is the deadline to register?

There is no deadline to register, however, before implementation, there is a 30-day notice requirement.

On a chargeback, do surcharge fees return to the customer?

On a chargeback, the purchase amount plus the surcharge should be credited to the cardholder. On a partial chargeback, the corresponding percentage of the surcharge should be returned.

Does surcharging affect me if my business does not accept cash?

Businesses can decide which legal tender(s) to accept. Should a business only accept credit cards, they can still choose to surcharge credit card transactions; however, the customer must have the option to cancel their purchase if they do not want to pay the surcharge.

Is surcharging permitted in Quebec?

Consumer protection laws do not allow for surcharging on consumer transactions. This applies regardless of where the consumer resides. However, businesses may surcharge on business transactions (B2B), as consumer protection laws do not apply.

Can I surcharge a Visa Debit card?

No, this does not count as a Visa credit card and cannot be surcharged.

If we send invoices through QuickBooks Online and they are the payment processor, do we still have to notify the credit card networks?

Yes, credit card networks must still be notified.

Can a business surcharge all credit card transactions that meet a certain value threshold (e.g., anything above $100)?

Businesses can decide which transactions to surcharge when customers decide to pay with a credit card. However, it would be very difficult for a business to pick and choose who to surcharge as this might attract scrutiny by consumer protection groups. Should you wish to implement criteria that has not been suggested by the surcharging rules (e.g., by product or by type), we recommend that you seek legal advice, create a clear policy, ensure customers are made aware of the policy before the point of sale, and implement it with consistency.

Will a response be sent from Mastercard/Acquirers to merchants after they submit their email notification that they intend to surcharge?

No, after submitting the webform to Mastercard, an auto-response is displayed on the screen. No other notification will be sent to the merchant.

As for the acquirer, the merchant must ensure that they have provided written notice to the acquirer of their intention to surcharge prior to implementing the surcharge. The name of the acquirer or processor must also have been included in the Mastercard webform. It is recommended that merchants contact the acquirer to confirm that the written notice has been received.

If I change acquirers, do I need to notify Mastercard or Visa?

Visa has shared there is no need to disclose a change in acquirer to Visa as the responsibility is on the new/previous acquirer to notify them.

We are waiting on Mastercard for a response; however, a merchant could easily fill out the notice of intent form to notify them of the change.

What are payment card networks?

American Express Canada Discover, The Exchange, Interac, Mastercard Canada, Visa Canada and UnionPay make up the seven major operators of payment card networks in Canada. To participate in these networks, merchants need to establish a contract with a payment service provider, such as an acquirer which provides them with access to the payment card network.

What is an acquirer?

An acquirer is an entity that enables merchants to accept payments by credit or debit card, by providing merchants with access to one or more payment card networks for the transmission or processing of payments.

CFIB Takes On The Credit Card Industry

Credit cards may be handy for consumers – but they can be expensive for merchants like you! Since 2008, CFIB has been negotiating with government and the credit card industry to level the playing field and lower processing fees for your business.

How CFIB is helping merchants like you:

With your support, we will continue to fight for:

- Lower interchange fees

- No swipe fees on GST/HST

- More fairness for merchants on “chargebacks”

- No fees on prepaid cards and refunds

Save even more on your credit and debit processing costs with CFIB

Looking for fair contracts and even more savings? CFIB members have access to exclusive low rates with Chase, one of Canada’s leading payment processors. Learn more here Information of Blog or speak to one of our Savings Program Specialists at 1-888-521-0223.

You can also speak to one of our Business Advisors at 1-833-568-2342 to ask any questions about the class action.

.png?width=690&height=690&name=MicrosoftTeams-image%20(26).png)