As of March 28, 2024, CEBA loan refinancing is closed. Any businesses with outstanding CEBA loans are required to pay them off in full by December 31, 2026.

Update and Recommendations from CFIB President Dan Kelly

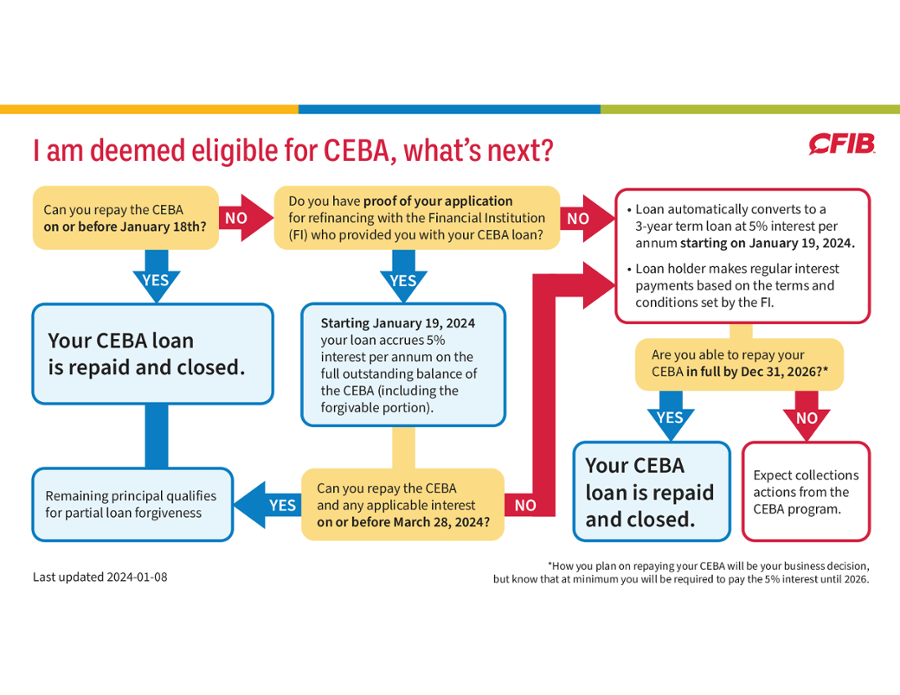

The deadline to keep the forgivable portion of the loan was January 18th, 2024.

If you applied for a refinancing loan on or before January 18th, 2024, with the Financial Institution (FI) that provided your CEBA, you qualified for a special extension to March 28, 2024, to keep the forgivable portion. This means that all opportunities to keep the forgivable portion of the loan have now passed.

Here are some important details on how this extension worked:

- There is no standard documentation requirement to prove you applied for refinancing on or before January 18, 2024. The federal government is allowing each bank to determine its own process so check with yours.

- While you needed to apply for a refinancing loan with the bank that issued your CEBA loan to qualify for an extension, you did not need to take that loan and were permitted to find alternative sources of funding before the March 28, 2024, deadline.

- If you were rejected for refinancing or denied the opportunity to apply for refinancing from your CEBA bank, you still qualified for the extension to March 28, 2024, as long as your account was in good standing and your FI confirmed your access to the March 28th deadline.

- Ensure you receive any decisions from your bank in writing so you can demonstrate that you applied for financing on or before January 18.

- During this special extension period, starting January 19, 2024, 5% interest will be charged on the outstanding amount of your CEBA including the forgivable portion.

If you didn’t have the capacity to repay or borrow to repay your loan, consider how you will repay the larger amount on or before December 31, 2026: If you didn’t receive the extension to March 28, 2024 from your bank, you have lost the forgivable portion, but your CEBA will convert to a term loan with a that can be repaid over 3 years (to the end of 2026). In addition, businesses will only be required to pay monthly 5% interest payments on the full outstanding balance of your CEBA (including the forgivable portion) and can pay the principal amount just before the term loan repayment deadline of December 31, 2026.

If your business has been deemed ineligible for CEBA, you do not qualify for the extension to January 18, 2024. Over 50,000 small businesses that received and spent CEBA loans during the pandemic have now been deemed ineligible for the loan in the first place. If deemed ineligible, the business does not benefit from the forgivable portion nor do they qualify for the extensions to January 18 or March 28, 2024. CFIB regards this as deeply unfair, especially as government has closed the process that allowed businesses to have their file reviewed or reconsidered. CFIB continues to advocate government for an extra year and a process to review files with minor errors to protect the forgivable portion. If your business was deemed ineligible:

- Your deadline to repay the loan in full was December 31, 2023.

- Starting January 19, 2024, you will be charged 5% interest on the full outstanding amount of your CEBA including the forgivable portion.

- The Canada Revenue Agency will begin contacting ineligible businesses in the spring of 2024 to collect from those who haven’t repaid.

- Government will assess repayment arrangements on a case-by-case basis. They have shared that there will be:

- no penalties, and

- based on your ability to repay, could offer repayment flexibilities of up to a 2-year repayment period.

- If you are unsure as to why you are ineligible, please call the CEBA call centre at 1-888-324-4201 and your Financial Institution to get clarity. If you have a situation that you would like CFIB to highlight in our advocacy, please send us an email at CEBA@cfib.ca.

If you need help, get in touch with us: CFIB Advisors are available to help you work through your options when it comes to paying off your CEBA loan and can provide guidance on many other issues. Give us a call at 1-833-568-2342 or reach out to us by e-mail cfib@cfib.ca.

UPDATE & RECOMMENDATIONS FROM CFIB PRESIDENT RE: RECENT CEBA CHANGES

As you know, the entire CFIB team has been working hard to push back the date at which point small businesses lose the forgivable portion of CEBA (up to $20,000).

After months of lobbying, dozens of meetings with MPs, and over 40,000 signed petitions from small business owners we have delivered to government since the start of 2023, the government announced changes to the CEBA repayment process on September 14, 2023.

The Prime Minister himself announced that CEBA loans would be extended by one year. Journalists, small business owners and even Liberal MPs all believed this meant that small business owners would have an extra year to repay $40,000 on their CEBA loan in order to keep the $20,000 forgivable portion.

But sadly, this isn’t true at all.

The confusion is that there are 2 CEBA deadlines. The first is the December 31, 2023 deadline to repay in order to keep the forgivable portion. That deadline was extended—but only by 18 days – to January 18, 2024.

The extra year is for those who miss out on the forgivable portion – they now have 3 years rather than 2 to pay back the full $60,000 CEBA loan (by the end of 2026). While this will be helpful for some, it is not the deadline small businesses were worried about.

Since this announcement, I’ve heard from hundreds of small business owners who feel that the government deliberately misled them on what was changing and that the change that was made misses the mark entirely.

Business owners have every right to be angry about how the government is treating them. The government is now telling business owners that they should simply convert their CEBA loan to a regular bank loan in order to secure the forgivable portion. In fact, the government has created a special provision allowing those who apply for a bank loan to repay CEBA before January 18 to have until March 28 to convert their loans in order to keep the forgivable portion. This is essentially like government telling a family struggling to pay their Visa bill to simply apply for a Mastercard.

Instead of two CEBA deadlines, we now have three. Here is a summary of these new dates.

| Previous Plan | Current Plan | |

|---|---|---|

| Deadline to keep the forgivable portion (up to $20K) by repaying the balance (up to $40K). | Dec. 31, 2023 | Jan. 18, 2024 |

| Deadline to keep the forgivable portion if you have an application in process before Jan. 18, 2024 for a bank loan to repay CEBA. | --- | Mar. 28, 2024 |

| Deadline to repay the entire CEBA loan (up to $60K) if you miss the forgivable deadlines. | Dec. 31, 2025 | Dec. 31, 2026 |

So where do we go from here?

First, despite the incredibly short time frame, CFIB will continue our campaign for further changes to the deadlines. Now that the government has pushed the forgivable deadline to January 18, 2024, we are calling on them to further move it to December 31, 2024 to give small business owners a full extra year to repay the $40,000 while protecting the $20,000 forgivable portion.

This, combined with the other changes they did announce, would make it a package CFIB can support.

But many business owners are asking us for advice on what they should do? Should business owners hold out hope for a further change, or is this the time to try to borrow $40,000 in order to pay the balance to ensure they are able to keep the $20,000 forgivable portion?

My best advice is that 2 strategies are needed:

- I ask you to join the final push for a further change to the repayment deadline. Make sure you sign (or re-sign) the new petition we’ve created to call on government to push the forgivable deadline to December 31, 2024. Share the petition with other business owners. Call your MP right away to let them know the changes are not good enough and a further fix is required.

- Take steps now to be prepared if government doesn’t make any further changes. If you do not have the money to repay up to $40,000 before January 18, 2024, it would be wise to see if your bank will offer you a term loan to allow you to keep the forgivable portion. In most cases, if you are able to get a term loan, it will be less expensive than losing out the $20,000 forgivable portion.

CFIB will do everything we can to get a further delay in the forgivable deadline. But as we can’t be certain that further changes will be made at the 11th hour, we want to ensure small business owners are prepared before January 18th of next year. CFIB is also working on a list of alternative lenders for those who are not able to secure a term loan with their bank.

As always, please feel free to call CFIB’s Business Helpline if our team can be of any assistance along the way.

We haven’t given up and we never go away. Thanks for your ongoing support!

Dan Kelly

President and CEO

CFIB and CEBA

See all the work CFIB has done so far to help your business with CEBA:

CFIB has been representing small businesses throughout this long haul and continue to be right there with you. We know this has been a tough program to navigate. During the last year we:

- Collected more than 57,500 petitions - THANK YOU!!!

- Sent multiple letters to all MPs,

- Raised it in countless meetings with government MPs and officials,

- Sent out many news releases pushing government to make further changes.

- Got support from 3 of 4 opposition parties (NDP, BQ, Greens) and all 13 provincial and territorial premiers

A few of CFIB’s CEBA wins:

Dec 30, 2023

CEBA website clarifies that for ineligible businesses CEBA collections will:

- Be managed by the Government of Canada and not FIs.

- Will begin as early as the spring of 2024.

- No penalties.

- Consider flexible payment plans on a case-by-case basis, such as payment arrangements of up to 2 years.

Sept 14, 2023

Deadline to repay the CEBA extended to Jan 18, 2024

- Extending the term loan repayment deadline by one year to Dec 31, 2026.

- Providing an extension to March 28, 2023 to receive the forgivable portion if borrowers have documented proof of application for refinancing with their CEBA FI.

- 5% interest per annum begins January 19, 2024.

Jan 12, 2022

Government extends the CEBA repayment deadline to Dec 31, 2023. After it would convert to a 2-year term loan until 2025.

March 22, 2021

Government extends the payroll application deadline to Jun 30, 2021.

Dec 4, 2020

CEBA+ expands the loan from $40,000 to $60,000 this would increase the forgivable portion from 10K to 20K .

Nov 2020

Government extended the application deadline to Mar 31, 2021.

Aug 31, 2020

CEBA application deadline is extended from Aug 31 to Oct 31, 2020.

Aug 26, 2020

Creation of a CEBA call centre to alleviate confusion and frustration from SMEs.

June 26, 2020

CEBA Non-Deferrable Expense stream launched.

April 16, 2020

Payroll stream criteria expanded from $50,000 -$1 million to between $20,000 and $1.5 million in payroll in 2019.

April 9, 2020

CEBA Payroll stream launched.

March 17, 2020

CFIB calls government to create pandemic financial support for firms experiencing a significant drop in sales.

Financing Options

While we caution you against rushing into a loan or financing since we hope to extend the repayment deadline, we have a list of resources to help you find the best option should the need arise.

Press Release

Read our latest press release: "CFIB statement on Premiers’ letter calling for a CEBA extension".

Press Release

Read our latest press release: "Not good enough: CFIB statement on CEBA extension".

Joint Letter

Read our joint letter to Deputy Prime Minister Freeland, co-signed by 250+ employer associations across Canada.

CEBA report

Read our report "Small Business Debt and CEBA: Fall Update" on the implications the federal government's CEBA repayment schedule changes could have on business owners.

Be part of the largest small business organization in Canada.

Join more than 100,000 successful independent businesses who benefit from expert advice, exclusive savings and a strong voice in government.